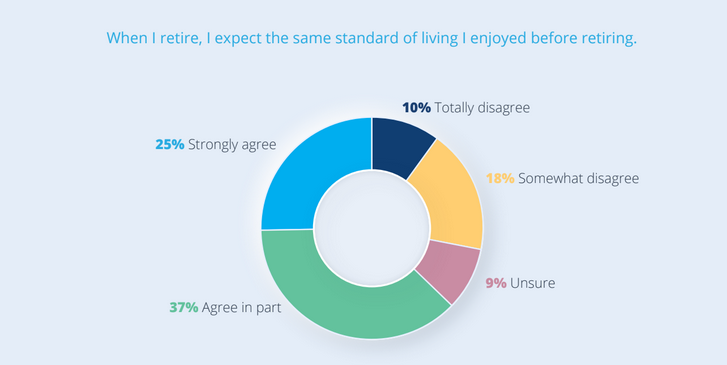

The 2021 edition of the 10X Retirement Reality Report points to a deteriorating pension outlook for South Africans.

In the wake of the Covid-19 pandemic, even fewer now look forward to a comfortable retirement, says Chris Eddy, head of investments at 10X Investments. This is evident across all age groups, demographics and income levels.

The 10X report is based on the annual Brand Atlas Survey, which tracks the lifestyles of the 15 million economically active South Africans in households earning more than R8,000 per month.

Alarmingly, this modest cut-off already excludes two-thirds of households in the country.

In total, 71% of respondents indicated they had no retirement savings plan at all, or just a vague idea of one. That is a lot of people who could be forced to rely on the kindness of family

and friends, or to live off South Africa’s meagre older person’s grant (state pension) of R1,890 per month (R1,910 for those older than 75), said Eddy.

Within the ‘fortunate’ minority, half the respondents still don’t save because they have nothing left at the end of the month. And even among those who are saving, just 7% anticipate a comfortable retirement; 79% fear they won’t have enough or feel unsure.

Most survey respondents (74%) believe they will have to generate some income after they retire. Another 19% are not very sure, leaving just 7% of respondents feeling confident that they are on course for what is increasingly becoming an outdated notion of retirement, based on full financial independence.

Breaking this down into different income groups: a mere 6% of those with a household income of R50,000 and above feel sure they will not have to keep earning after they retire. For both other income groups, it was just 7%.

This highlights once more that achieving a financially secure retirement is less about how much we earn, and more about how much we engage in the process, inform ourselves and save.

But how much is enough, and how do we start a savings plan to get there? Several leading financial services firms weigh-in:

The 80% rule

Schalk Louw, portfolio manager at PSG Wealth, notes that many experts recommend using the 80% rule as a benchmark for what you will need to cover your monthly expenses once retired.

“I won’t personally guarantee the accuracy of this figure, but it does give us a basis to start from,” said Louw.

If you currently earn R15,000 per month, and apply the 80% rule, you will need at least R12,000 per month after retirement to maintain your current living standard.

Unlike food products, human beings don’t have a “use by” date, so we have to rely on a safe withdrawal rate to ensure that we do not outlive our savings, said Louw.

According to this rate, you should be able to withdraw 5% of your portfolio yearly without having to use any of your remaining capital, he said.

“This approach is based on the fact that the historical return on the South African stock market (since 1964) was about 8% higher than the local inflation rate and that you would expect to earn slightly less than that in a typical balanced fund portfolio.

“By limiting your withdrawals to 5% of your portfolio, you should still have an additional 5% to 6% growth to cover inflation in the long run.”

Based on a 5% annual withdrawal rate after retirement, Louw said that the amount you will need to save in rand terms would look something like this:

R12,000 x 12 months = R144,000 (annual income) ÷ 0.05 (5% safe withdrawal rate) = R2,880,000.

If you don’t properly compensate for inflation in your portfolio, you may fall short of your required total after retirement, said Louw.

“Let’s assume that you are 40 years old and you plan to retire at age 65 (25 years). By using the top of the South African Reserve Bank’s target range, the best-calculated guess we can offer on annual inflation is around 6%.

The 4% rule

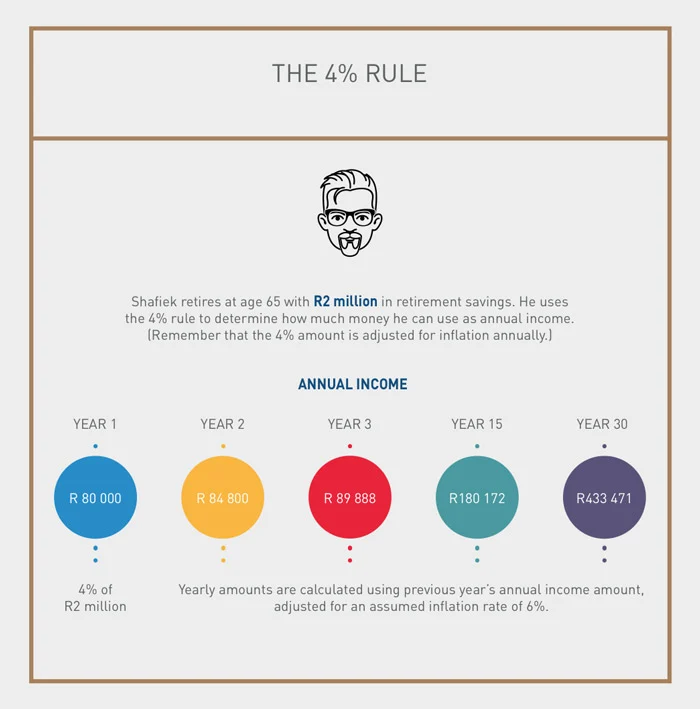

Traditionally, financial advisers, savers and retirees have relied on the 4% rule when working out how much to save for retirement and what kind of annual income retirement savings would provide, noted financial services group Discovery.

Simply put, the rule says that if retirees withdraw 4% of their savings annually (adjusting this amount for inflation every year thereafter), their nest egg will last at least 30 years. The rule also requires retirement savings to be split equally between shares and bonds.

This method, Discovery said, is also used to determine the lump sum investors need to provide an acceptable annual income when they retire.

For example, if you retire with a final salary of R480,000 a year, you need a replacement ratio of 90% of your final salary, which amounts to R432,000. To ensure you do not use all your saved retirement capital in 30 years, R432,000 should be 4% of your total savings, Discovery said.

This means you would need R10.8 million saved to draw 4% or R432,000 annually. Put another way:

- You need R432,000 a year (90% of R480,000).

- R432,000 must be 4% of your total savings at retirement if you don’t want to deplete your nest egg.

- R432,000 is 4% of R10.8 million

- Therefore, you need R10.8 million saved at retirement to give you R432,000 a year.

“This retirement theory is not without its critics. Those who question the 4% rule’s relevance say it doesn’t take into account issues such as taxes or varying investment horizons, and also observe that financial conditions when the rule was formulated were very different to the reality in this century,” the financial services firm said.

For example, Bengen’s rule is based on the average long-term annual returns (since 1926) of shares and bonds being 10% and 5.3%, respectively.

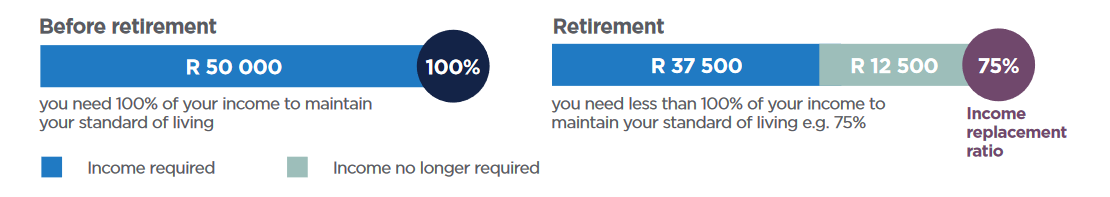

Plan to have 75% of your current pre-tax income, says financial services firm, Sanlam. “You will most likely need less than 100% of your current income to live comfortably when you retire as some expenses fall away once you retire.”

Ask yourself these questions:

- What would I no longer pay for when I retire? The things I don’t need or no longer have as expenses.

- What would I still pay for when I retire? The things I need to cover like living expense and lifestyle aspirations.

- What expenses may start or increases? This may include new hobbies, aspirations like travel, and healthcare costs.

Determine your income replacement ratio, said Sanlam. This is the income you get after evaluating the questions above, expressed as a percentage of your current income.

Example: earning a monthly income of R50,000 pre-tax

Allan Gray offers a similar guideline around saving. Aim for an income of 75% of your final salary.

It is widely held that a retirement income equal to 75% of your final salary will allow you to live comfortably during retirement, it said. “This figure accounts for the adjustments many people make as they age, for example, no further retirement savings contributions but higher medical costs.”

To assess how much you will potentially need, consider the following factors:

- Housing. Do you expect to own your own home when you retire having paid off your bond? If so, you can remove home payments from your budget. If you expect to buy or rent a bigger home between now and when you retire, you’ll need to increase your allocation for housing.

- Transport. Will your car be paid off or are you planning to buy an expensive car that will need to be paid off during retirement?

- Medical expenses. As you get older, your doctor’s visits, medication and medical aid contributions are likely to start increasing. In addition, medical inflation is usually higher than the average inflation.

- Education. Will you still need to pay your children’s or grandchildren’s school fees? Education inflation is typically around 4% higher than the average inflation.

Aim to put away at least 17% of your salary from age 25

“Assuming that you will be comfortable living off 75% of your pre-retirement salary, our research indicates that saving 17% of your salary is a reasonable starting point for the 25-year old saver.

“This amount increases dramatically the later you start. You need to save 22% if you start saving at 30, up to 42% if you start at 40, and up to 59% if you start at 45,” Allan Gray said.

It is important to note that these numbers are simply averages and assume a consistent, inflationary salary increase each year, that you retire at 65 and that you earn an average return of consumer price inflation (CPI) plus 5%, it said.

The 15% rule

The general rule of thumb for a comfortable retirement is 15%, noted Gus Van Der Spek, a developer of upmarket retirement village Wytham Estate.

“15% of your salary should be put aside for your entire working career of around 40 years. For those wanting to retire in luxury, 20%-plus is advised. Also, bear in mind that what R1 is worth now will differ by the time that you retire,” he said.

Van Der Spek shared the advice given to him by financial planners saying, “multiply your needs by 300. Simply put, if you currently live on R50,000 per month, multiply this by 300 to determine what you will need to maintain a luxury lifestyle post the age of 60.”

Van Der Spek’s comments dovetail retirement expert Andre Tuck, a senior Investment consultant at 10X Investments.

Tuck pointed to three old school ways to ‘guesstimate’ your retirement goal:

- 1: Multiply your final annual salary by 15

“Let’s say your take-home pay is R25,000 a month in your final year of working, giving you an annual salary of R300,000,” said Tuck. “To maintain your lifestyle after retirement, you’ll need around 15 times your annual salary, so 15 x R300,000, meaning a lump sum of roughly R4.5 million,” he said.

He added, however, that if you are hoping to do things you didn’t do during your working years, for example, travel, you should rather multiply your final salary by 17, or even 20.

- 2: Save R1-million for every R5,000 you want to draw down as a pension every month

You can also get a rough idea of how much money you’ll need to have saved at retirement by assuming that you will need R1 million invested in an annuity for every R5,000 you want to draw a month once you’re retired. So, if you want to draw a monthly pension of R25,000 a month, you will need to have squirrelled away R5 million by the time you retire.

- 3: Multiply your monthly needs by 300

One of the simplest calculations is to multiply what you think you’ll need per month (say R25,000) by 300 to determine the lump sum you will need to have saved (R7.5 million in our example). This option gives a slightly higher figure than the other two options, which is a good thing, says Tuck.

“The more money you have available to invest once you retire, the better your lifestyle will be and the more likely you will be to withstand the impact of unexpected events, such as the current pandemic,” he said.