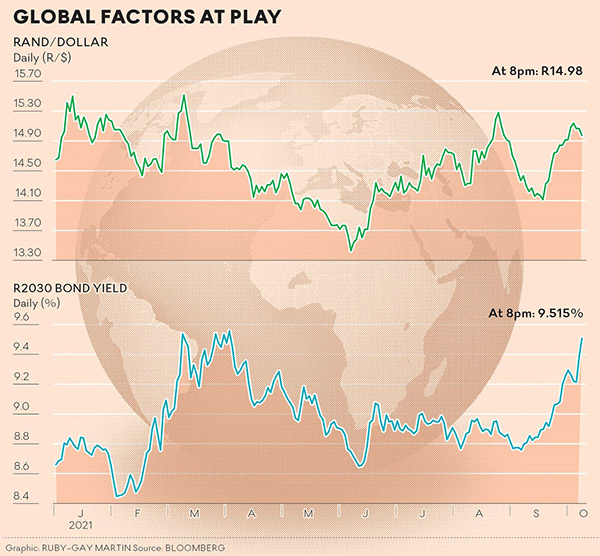

The question is where to now after breaching R15/$ for the first time in more than two months

The rand, often a proxy for global sentiment towards emerging-market assets, has taken a beating the past month, sliding almost 5%. The mystery is where to now after breaching R15/$ for the first time in more than two months.

Among the more bearish analysts, Bianca Botes, a director and treasury partner at Citadel Global, said it can go as low as R16/$, a level it has not reached since November 2020. It implies another drop of just less than 7%. On the other end, Shaun Murison from IG sees it settling between R14.50/$ and R15.50/$. A Bloomberg survey offers even less clarity. While the median prediction is for it to end the year at R14.75/$, the forecasts range from R13/$ to R17.03/$.

Sentiment has taken a beating over the past few weeks with myriad concerns on investors’ minds, including the ever-nearing tapering of stimulus by the US Federal Reserve that would reduce demand for riskier but higher-yielding assets.

Central banks globally are torn about how, if at all, to react to an energy crunch that may entrench what they previously assumed to be a temporary spike in inflation due to Covid-19 induced supply distortions. Then there has been the crisis in China’s property market and its impact on the world’s No 2 economy, which is also one of the main customers for SA’s commodities.

“The rand will continue to take its cues from the global landscape, however, in a world of normalising monetary policy, the bias is towards a weaker rand,” said Botes, adding that it could move closer to R16/$ by end-2021, “given the current risks, as well as the looming tapering”.

Bond yields

By 5.50pm on Tuesday, the rand was trading 0.4% stronger at R14.9845/$, cutting its decline for the past month to 4.6%. Over the past year, it is 11% stronger, according to Bloomberg data, meaning that the recent decline, which may push up prices of imported goods, will not worry the Reserve Bank yet.

SA bonds have not been spared the risk-off sentiment, with yields, which move inversely to the price, creeping up to their highest levels since April. They have risen 25 basis points, or 0.25 percentage points, in the past two trading days to 9.5%, the highest since early April.

In addition to inflation concerns, the moves also reflect continued uncertainty about the country’s fiscal position, even after a recent rebasing of GDP that improved its credit metrics. The yields could also help support the rand by attracting investors into local assets.

“SA continues to have higher real interest rates in a lower for longer global monetary policy environment, making domestic bond yields attractive,” said Murison.

“A yield of over 9% on the 10-year is literally double that of domestic inflation. Carry trade opportunity does support appetite for the local bond market though rising yields in the US does start to lessen the benefit.”

Budget statement

The carry trade refers to borrowing in a low interest environment to invest in a higher-yielding one.

Analysts are also turning their focus to the medium-term budget policy statement on November 4, with many mulling how the Treasury will be guided by finance minister Enoch Godongwana, who took over from Tito Mboweni in early August.

Bloomberg data indicates the rand will stay among the most volatile currencies this month, a period that will also cover the local government elections, on November 1. One-month implied volatility for the rand against the dollar was at 15.9% on Tuesday, slightly down from 16.13% on September 28, which was the most since April 6.

“The new finance minister will need to ensure that economic support is sustained while keeping an eye on increasing debt and expenditure levels,” Murison said.