A Russian invasion of its neighbor might, at least in the short term, extend 2022’s volatility in the stock and commodity markets.

The safety trade could be in full force now that Russian President Vladimir Putin has ordered troops into separatist regions of eastern Ukraine. But equity investors would be wise to keep calm and carry on, market strategists say.

True, risk assets such as stocks tend to retreat when geopolitical crises dominate the headlines. Meanwhile, safe havens, such as Treasuries and gold, catch a bid. This particular crisis has rippled across commodities markets as well. Crude oil popped because Russia is a major energy supplier. Prices for a number of agricultural commodities jumped too, as Russia and Ukraine together account for about 20% of global corn exports and 25% of wheat exports. But as dramatic as the price action across various asset classes might be, that shouldn’t change most retail investors’ basic calculus or long-term plans.

But as dramatic as the price action across various asset classes might be, that shouldn’t change most retail investors’ basic calculus or long-term plans.

How Markets Have Historically Weathered Conflict

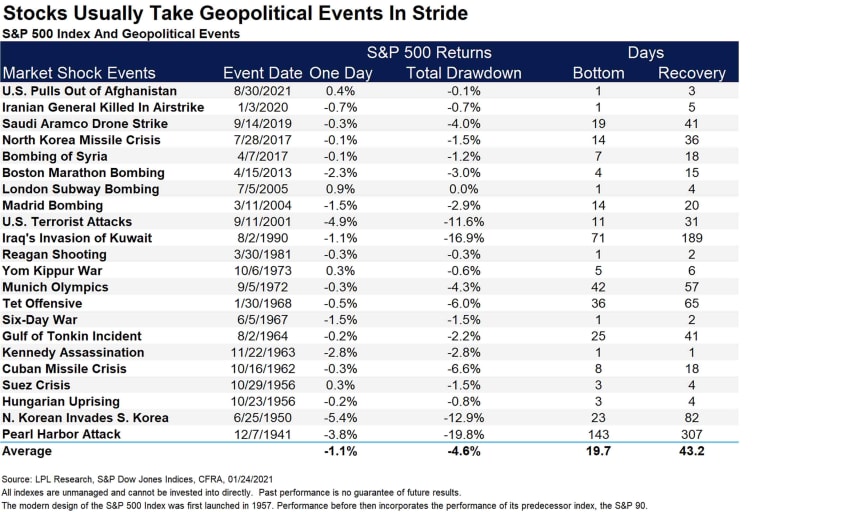

History shows that stocks usually take global saber-rattling events in stride.

“As devastating as a major conflict could be between Russia and Ukraine, the truth is stocks likely will be able to withstand the geopolitical struggle,” writes Ryan Detrick, chief market strategist of LPL Financial. “In fact, looking back at other major geopolitical events throughout history reveals stocks usually take them as a nonevent.”

Just look at past market performance following similar geopolitical strife, courtesy of LPL Financial:

But that’s not to say Russia’s actions in Ukraine don’t complicate matters in the shorter term.

Russia-Ukraine’s Impact on Commodities and Equity Industries

Rising energy and agricultural prices only exacerbate worries about inflation – a top-of-mind anxiety for investors and the Federal Reserve alike. The conflict in Eastern Europe could reinforce the market’s current preferences, which include an appetite for value names at the expense of growth stocks.

“[Although] Russia-Ukraine tension is a low earnings risk for U.S. corporates, an energy price shock amid an aggressive central bank pivot focused on inflation could further dampen investor sentiment and growth outlook,” says Dubravko Lakos-Bujas, JPMorgan Chase’s global head of equity research.

A number of strategists share similar concerns, especially as they relate to energy prices. But even there, the outlook is by no means black and white, says Raymond James senior economist Scott Brown.

“If the result [of the current crisis] is similar to Russia’s annexation of Crimea, there should be little impact on the U.S. economy,” Brown writes. “Higher oil prices could be a factor, but energy is a lot more neutral in its effect on the economy than in past decades.”

Brown adds that if gas prices do continue to rise, even that is not an entirely bad thing. Although higher prices at the pump would add to inflation and dampen consumer spending, they also could boost business investment by encouraging more exploration.