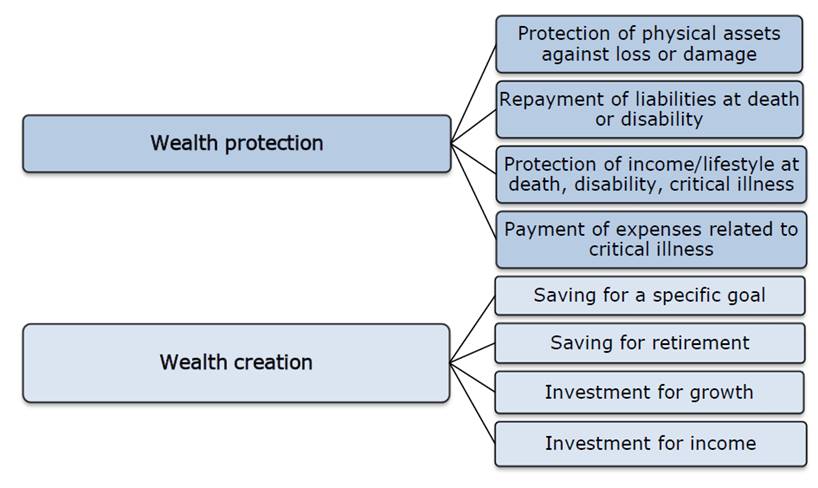

Wealth Protection:

Refers to the need to protect yourself, your family and your assets against losses caused by unforeseen events. If you do not plan properly by taking out insurance, an unplanned event could result in assets having to be sold to raise the needed money. This event could be a fire, theft, critical Illness, disability or death … would either of these events put you into finical difficulty? Would your family be able to maintain their current lifestyle should you become ill, disabled or die?

Wealth Creation:

Focuses on your need to create new assets and to add to the value of your assets that you have already accumulated. Wealth creation includes saving for a particular goal or investing money for further growth or income. Part of the wealth creation process involves the management and monitoring of investments, to ensure that funds are invested in a manner that is suitable to your profile and goals, and that the funds are structured in the most cost-and tax-efficient manner. Is the investment vehicle you using the most tax efficient? Are you reaching that financial goal?

At Innov8ions Financial Services we are able to assist with all your wealth protection and creation needs. Call Natasha on 0747311019 or email natasha@innov8fs.co.za should you require a holistic needs analysis to ensure you are on the right track to protecting you and your family.

At Innov8ions Financial Services we are able to assist with all your wealth protection and creation needs. Call Natasha on 0747311019 or email natasha@innov8fs.co.za should you require a holistic needs analysis to ensure you are on the right track to protecting you and your family.