Holding your savings in cash may expose investors to minimal volatility and uncertainty. However, it will most likely result in the investment failing to grow at a rate significantly faster than headline inflation over the long term.

This will result in the investors’ purchasing power stagnating and possibly declining over time as inflation erodes the value of their savings.

However, cash investments still play an important role in any investor’s portfolio, providing a buffer against shocks and preventing the need to sell other asset classes prematurely.

This is feedback from Old Mutual Investment Group (OMIG) portfolio manager Urvesh Desai, who outlined why cash is trash over the long term.

Desai outlined this in a research piece in OMIG’s annual Long-Term Perspectives report, which is where the asset manager analyses long-term investment trends and how they impact portfolios.

These trends include the changing nature of the global economy, how different asset classes behave in different scenarios, and how Old Mutual’s portfolios have changed over time.

As part of this, Desai analysed the performance of cash investments over time, using OMIG’s data over the past 95 years.

Desai was clear in saying that there are very few other options than cash to park your money for the short term, as it guarantees some return and prevents any loss of capital.

This is even true in a retirement investing framework where you use the lump sum retirement benefit to, for instance, pay off debts or take a holiday.

Investing this portion in cash may be an appropriate decision, and you would be able to sleep soundly knowing that your capital is safe.

However, over the long run, there is a substantial price to pay for holding your investments in cash, as it is unlikely to significantly beat inflation.

While keeping capital safe in the short term is important, an investor also needs to ensure they maintain the buying power of their savings and even try to increase it.

This means generating returns over and above inflation as it steadily erodes the value of money and, thus, of savings and investments.

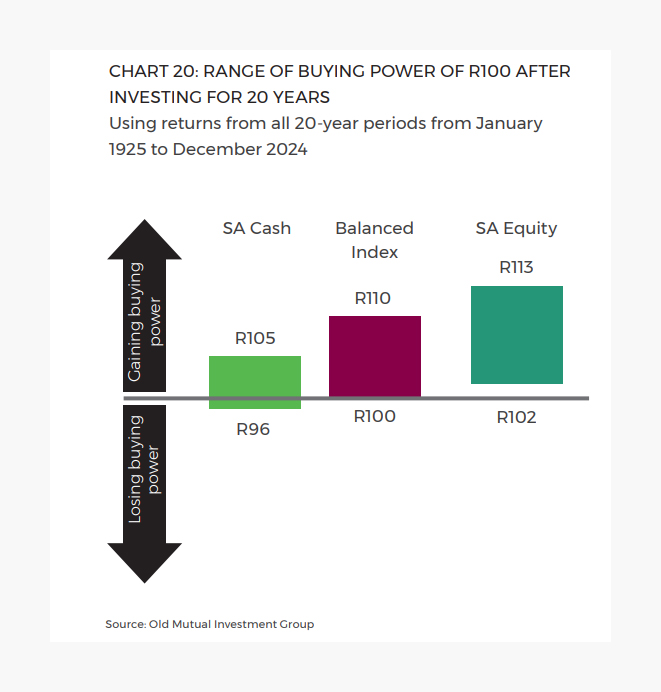

History shows that investing in cash gives you the greatest risk of losing your buying power over time. This is illustrated in the graphic below, which displays the range of returns for various investment strategies over a 20-year horizon.

Doubling your money

A major problem with investing your savings in cash is the time it takes for that money to grow without additional capital being invested.

In effect, due to the low return on cash, its compounding rate is much slower than it is in higher assets that can generate greater returns.

Desai explained that to better understand the risks of investing your savings in cash, one should look at how long it would take to double one’s real investment value.

Using each asset class’ long-term average returns, Desai showed that there are significant differences in how long it would take for the investment to double in value.

For one’s investment in cash to double, it would take 87 years in comparison to 42 years for South African bonds and only 11 years for South African equities.

However, this does not mean that other asset classes always outperform cash. On rare occasions, it has been among the best-performing investments.

Most recently, in 2022, a cash investment would have outperformed most equity indices, bonds, and other asset classes.

In this situation, Desai urged investors to remember their longer-term perspective and stick to a long-term investment strategy.

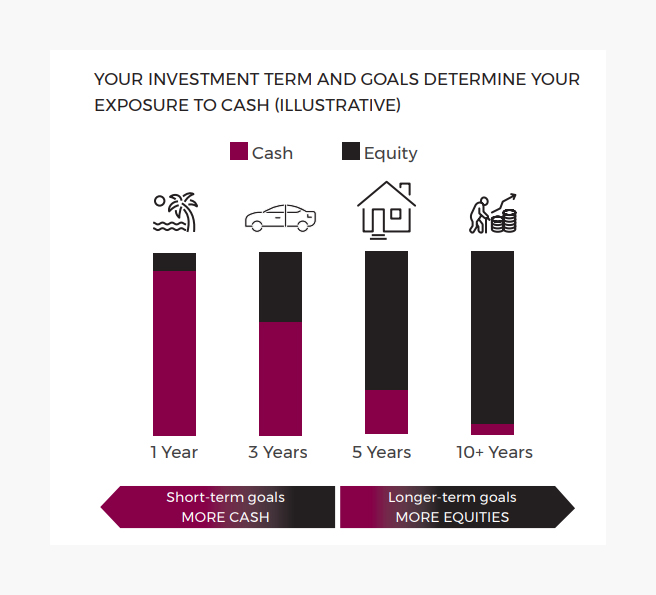

Desai explained that a common mistake people make in these situations is to match a long-term need, such as retirement, a property, or the education of their children, with a short-term asset.

Over the longer term, investors need greater exposure to equities to drive returns to enable better outcomes in retirement, for example.

In the short run, an investor can park their capital in cash to save up for a holiday, for example, or even a car.

To reiterate, for cash, the longer you stay invested, the greater the chance of eroding the buying power of your savings.

The chart below provides a simple overview of how an investor should allocate their capital based on their long-term needs.