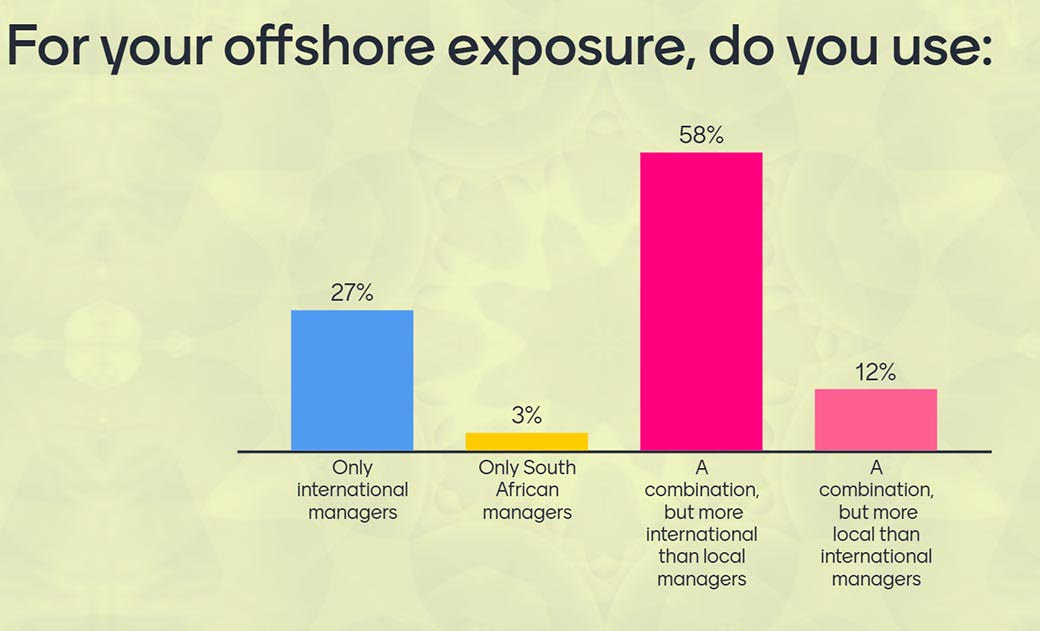

Delegates polled at the Citywire South Africa Retreat 2022 showed a clear preference for international asset managers when investing offshore.

Twenty-seven percent of the fund selector audience use only international managers in their offshore allocations. Fifty-eight percent use both South African and international managers, but with a preference for the latter.

This is a clear challenge to the local industry. If offshore allocations are going primarily to international asset managers, that could mean hundreds of billions of rands could leave the country following the increase to offshore limits.

And with talk that institutional exchange controls could be removed entirely in coming years, that number could be even more significant.

There is of course still a lot of debate around what the optimal international allocation is for a local investor. Over the last few months, a number of asset allocators have run models looking at what percentage of a portfolio it makes sense to have invested outside of South Africa, and there are many different numbers floating around.

For many asset managers running balanced funds, the feeling seems to be that the ‘right’ number is well shy of 45%. Figures between 25% and 35% seem to be most commonly put forward.

Going long

However, discussions with delegates have suggested that some DFMs may be thinking about this very differently. South Africa is a small, faltering economy, and questions have to be asked about whether it makes sense for anybody to have the bulk of their wealth invested here.

The biggest reason for a lower offshore allocation is the volatility of the rand. It is a concern when returns have to be translated back into the local currency particularly for investors drawing an income, but it’s not an intractable problem.

Hedging strategies are an effective, and very inexpensive, way of reducing that risk over the longer term. And a bucket or barbell strategy can easily be employed to give investors exposure to local fixed income for their short term or diversification needs, while the bulk of their ‘growth’ money is invested outside of the country.

The opportunity set outside of South Africa is so much greater and the country-specific risks so high, that this is a compelling argument. And it suggests that the trend towards higher offshore allocations may have a long way to run.

Other factors

However, it would be wrong to assume that local asset managers will inevitably be on the losing end of this shift. There are factors at play that may turn in their favour.

The first is simply that many local managers have demonstrable offshore capabilities. It is not, for instance, much of a reach to say that some of the best global property managers anywhere are based in Johannesburg and Cape Town. It’s hard to imagine that any fund selector is going to gain much, if anything, by looking beyond Reitway, Catalyst and Sesfikile in this sector.

And many local asset managers are building capacity in other global asset classes. From index providers to managers with high active share, South African firms are seeing the need to have global offerings.

Regulators could also add their support by making it possible to register funds denominated in hard currency in South Africa. That would make it easier to externalise money with local managers.

There is also a cloud hanging over South Africa with the potential that the country could be moved onto the Financial Action Task Force’s ‘grey list’. This would flag South Africa as being a higher risk for money laundering.

Practically, it would mean that international asset managers would have to go to a lot more trouble to onboard South African institutional investors. That process will inevitably become longer and more admin-intensive.

That could make allocating money to local managers, where the same constraints won’t apply, more attractive.

Being proactive

Finally, there is the question of transformation in the local industry. A majority of delegates polled at the Citywire South Africa Retreat said that they consider diversity and transformation to some degree in manager selection.

If these allocators are genuine in their intentions to see the industry transform and develop capacity, then they should want to keep more of their money within the local industry. Those asset managers that can demonstrate true transformation credentials and the skill and capacity to manage international mandates should benefit.

So, while there is clearly a risk to the local industry as more money can, and will go offshore, conversations with local fund selectors suggest that it’s not a one-way shift. South African asset managers could still hang onto a lot of that money – if they are proactive about taking the right decisions.