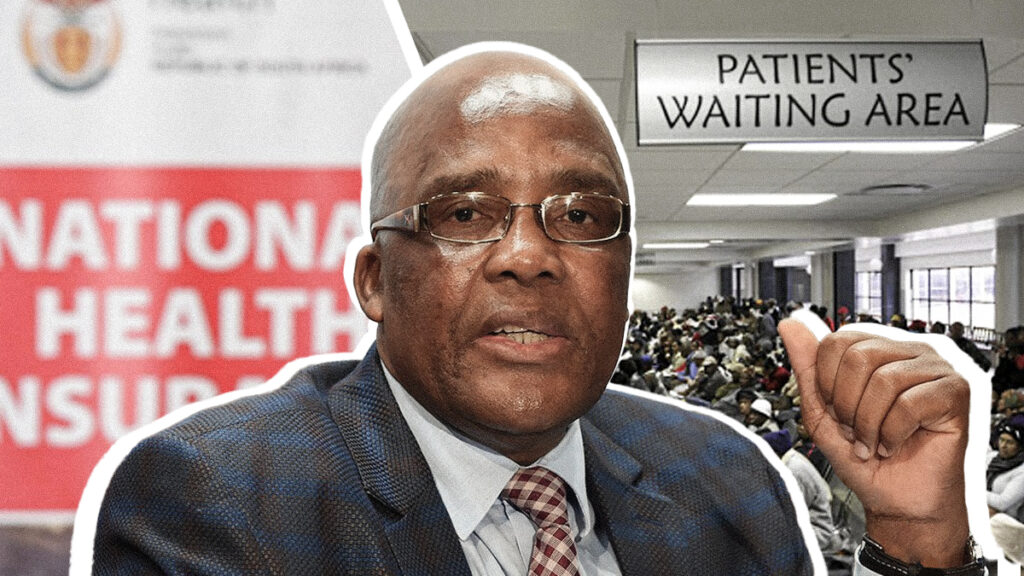

The implementation of the government’s National Health Insurance (NHI) scheme in its current form will require personal income tax (PIT) rates to more than double in South Africa.

Healthcare spending will also consume a third of the state’s entire Budget, if spending from increased taxes are completely redirected to the NHI.

However, this is unlikely, with spending on healthcare being one of the most inefficient in the government. As a result, health expenditure may consume up to 44% of the country’s Budget.

Apart from the lack of economic viability, this threatens to collapse the current healthcare system, resulting in a 43% reduction in access to care for South Africans who pay for private medical aid.

This is feedback from the Health Funders Association (HFA), which represents over 21 medical aid schemes in South Africa and three administrators.

The HFA said that tax increases to fund the NHI will impact South Africa’s working class the most, with lower-income individuals also set to bear the brunt of the end of private medical aids.

It explained that its data shows that of the 9.1 million South Africans on medical schemes, over 83% earn under R37,500 per month.

These medical scheme members also already constitute a large part of the country’s tax base, paying 74% of the PIT worth R443 billion.

This is based on analysis by Genesis Analytics, which was commissioned by the HFA to study the NHI’s financial implications in preparation for its legal challenge.

The government has said the NHI will provide comprehensive, high-quality healthcare for all South Africans for free at the point of service.

While this may be a laudable goal, it will come at an immense cost to South African taxpayers, who will foot the bill for the NHI.

Genesis Analytics’ study showed that achieving this promise would require PIT to more than double, rising to 2.2 times the current average rate.

In this scenario, healthcare spending would consume 33% of the national Budget. In less efficient scenarios, taxes could triple, and health expenditure may take up to 44% of the Budget.

This is based on the assumption that tax increases would be entirely directed to healthcare and that there would be no additional allocations to other needs.

Even pooling together all existing healthcare spending, both public and private, would require PIT to rise by 1.5 times its current rate – a 47% increase in tax rates.

Collapse of healthcare and the economy

South African taxpayers will be hit with a double blow with the NHI, as it will bring private medical aid coverage to an end.

Section 33 of the NHI Act prohibits medical aid schemes from covering any service that the NHI covers, seriously limiting private coverage.

This means that even if individuals have the means and willingness to buy private cover, they will be barred from using it for services provided by the NHI.

According to the HFA, this would result in the NHI risking collapsing the current healthcare system in South Africa by removing an alternative safety net and potentially resulting in healthcare rationing.

Even in Genesis’s best-case shared resources scenario, medical scheme beneficiaries would experience a 43% reduction in access to care.

Combined with the ban on supplementary cover, the state will be actively preventing individuals from accessing high-quality care, the HFA said.

In addition, draining funding from other areas into a single centralised system without the capacity to deliver jeopardises health outcomes, jobs, and investment.

Funding the NHI will also crowd out spending in other areas of the economy, slowing economic growth and impacting service delivery.

“The steep tax increases required to fund the NHI will reduce disposable income, curb consumer spending across all sectors of the economy, and may trigger an exodus of high-income taxpayers,” the HFA said.

An alternative to steep tax increases for personal income taxpayers is potentially an increase in VAT, which is broad-based and does not risk squeezing an already small PIT tax base.

While VAT is not mentioned in the NHI Act as a means to raise funding, the estimated increase in the tax to fund the scheme would be around 20%, taking VAT from 15% to 36%.

Discovery CEO Adrian Gore has previously said that these severe tax increases would crush the South African economy and are unsustainable.

“That would wreck the economy and does not do enough for anyone. You need more funding,” Gore said.

“It’s not a healthcare issue – it creates a real economic problem. I don’t think people would bear paying 30% more taxes and having 70% less healthcare.”