It doesn’t really matter what the rand does this year, say analysts: the big growth themes driving markets are all to be found abroad

It’s not an easy time for investors pinning their hopes on the South African stock market.

A dwindling number of investable stocks on local bourses, a flat performance in 2023 and an economy all but stalled as the government stumbles from one policy blunder to another have sapped the life out of the local market. Not to mention how those locally listed companies that do have some ammunition left are opting to explore overseas opportunities rather than deal with the government’s plethora of investment obstacles.

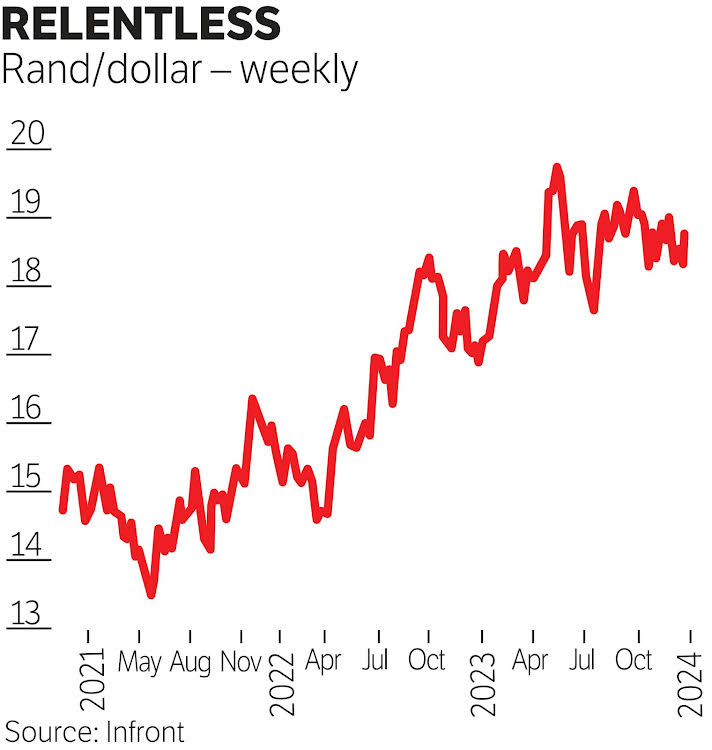

The JSE all share index was up 5.3% in 2023, compared with the the S&P 500’s 24.4% gain over the same period. The rand, weighed down by a strong dollar, stuttering economic growth in China and the whims of South African politicians, has weakened almost 9% over the past 12 months.

What the currency does in the next 12 months is anyone’s guess. “The rand will probably be in the range of R18.50-R19 [a dollar this year],” says Peter Armitage, MD of Anchor Capital. “But it isn’t unusual for the rand to move R2-R3 either way.”

Unless the US economy experiences a major shock to the downside, the dollar is set to cling to its value this year. In December, the US economy added 216,000 jobs, according to the country’s labour department, considerably more than analyst expectations of 170,000, showing how much firing power is left in the world’s biggest economy. The number also seriously dented the case for an imminent rate cut by the US Federal Reserve.

“The dollar has been very strong against all currencies,” notes Armitage.

When rates come down — by however much — it will be a trigger for equities

David Shapiro

But David Shapiro, chief global equity strategist at Sasfin Securities, says he won’t be surprised if the Fed and other central banks start to cut rates this year. “When rates come down — by however much — it will be a trigger for equities,” he says.

On the flipside, China, the largest destination for South African exports, is struggling to regain the economic growth of not so long ago. According to Oxford Economics, the world’s second-biggest economy will grow 4.4% this year.

“The persistence of domestic regulatory uncertainties will temper the investment recovery, excluding property, in 2024,” the research outfit writes in a note.

“China is the second-most important [factor] for [the rand],” says Armitage. “[It depends] on whether they will get their growth back.” Growth would imply appetite for the commodities that we mine and sell.

Then there’s a third factor: the current political stewardship of the economy.

With haphazard electricity generation, failing local government infrastructure, BEE regulations that stifle foreign direct investment and the populist rhetoric of an election year, the rand is hardly likely to receive much local support.

So where does this leave investors? “South Africa constitutes less than 1% of the global equity market,” says Armitage, adding that from a diversification point of view, it makes sense to ship some investments abroad.

Shapiro points to certain investment themes that may remain popular this year. For one, the excitement stirred up by AI will continue to draw investors’ attention.

“The AI story is still going strong,” he says. “The benefits of AI will come from company spend.” For instance, the move to cloud computing and demand for software utilising AI will continue to accelerate, he says. The key companies specialising in this sector are all offshore — and mostly US-based.

Then there’s the weight-loss drug phenomena unleashed by pharmaceutical companies Eli Lilly and Novo Nordisk. “Don’t take this theme lightly,” says Shapiro. “There is massive demand for these drugs.”

If a local investor wishes to benefit from any of these themes, they’d be hard-pressed to find South African stocks offering such access. It means going offshore is a necessity.

But, warns Armitage: “It is significantly harder to invest offshore now.”

That’s due to two issues. First, people older than 18 can invest R10m abroad, but this limit hasn’t been adjusted for inflation for almost nine years; that R10m from 2015 is now worth R6.5m.

Second, says Armitage, it’s no longer just the Reserve Bank that has to sign off on sending money abroad; the South African Revenue Service has now made investing offshore a tax compliance tool. Anyone who wants to apply for their R10m offshore allowance must prove that their domestic tax affairs are in order. Another hoop to jump through, then.