Foreign investors have accelerated their (net) selling of equities on the JSE, with sales 40% greater thus far in 2023 than in the same period in 2022. To last Friday, non-SA investors sold a net R103 billion of equities, versus R73 billion in the first 40 weeks of last year.

Year to date, the JSE All Share Index (Alsi) is down 1.1%. (The flows picture for bonds, while still barely positive for the year, is down 70% versus 2022.)

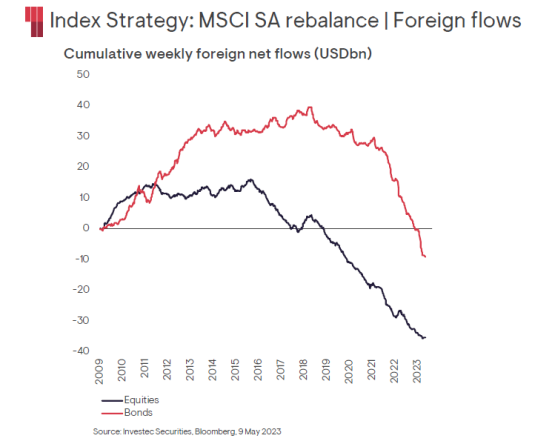

Foreign selling has been a firm theme of the past four years, with the last burst of net buying being a ‘Ramaphoria’ induced pop in 2018, following Cyril Ramaphosa being appointed president.

The decline began in the final years of the Jacob Zuma administration. This is according to a chart from Ninety One, understood to be part of a presentation to clients and published on X (neé Twitter) by investor and well-known commentator Karin Richards.

Cumulatively, outflows are almost certainly more than $40 billion by this stage (the chart has data to May 2023).

The steadily weakening rand impacts the returns of foreigners, and with domestic earnings growth moribund – or non-existent – there’s not an awful lot to be excited about. In dollar terms, the performance of our market is among the worst in the world.

According to data from PSG Wealth Old Oak, the South African country ETF (exchange-traded fund) is the third worst globally when measured to Friday, 6 October. The ETF is down 11.3% this year; the two worst performers, Thailand and Hong Kong, are at -17% and -16%, respectively.

It does not help that investors are pulling their money from emerging markets.

A Bloomberg report this week noted that “outflows from US-listed ETFs that invest across developing nations as well as those that target specific countries totalled $3.12 billion last week”. This was the largest weekly outflow this year, where net inflows only total $6.86 billion.

These flows are important as mega-funds – such as the iShares MSCI Emerging Markets ETF, with close to R500 billion in assets – are forced to trim their holdings across the board if investors withdraw their capital.

In August, there was sustained and substantial selling of three JSE shares, MultiChoice Group, Mr Price Group and TFG Limited, due to a rebalancing of the MSCI Emerging Markets Index. These three stocks were removed from the index due to South Africa’s weighting in it being reduced. One estimate put the outflow due to this selling at around R7 billion ($360 million).

Writing in the June quarterly review for the Ninety One Value Fund, which he manages, portfolio manager John Biccard says: “The perfect storm of several factors has resulted in an unprecedented selling of SA equities by both local and offshore investors. These include political upheavals, load shedding, weakening commodity prices and the loosening of regulations around maximum offshore exposure for South African portfolios.

“As a result, foreign investors have sold local equities for 48 of the last 54 months and now are positioned at half the benchmark weight in South Africa within the emerging market index. Local investors are fast approaching the 45% maximum allowed in offshore holdings.

“The result is a plethora of 7X PE and 7% dividend-yielding stocks, as the herd continues to sell quality SA stocks on 7% yields in order to convert their one rand into 5 US cents, and then buy US tech stocks on 0.5% dividend yields.”

Knock-on effects

One knock-on from these outflows has been a reduction in trade volumes and values on the JSE. Investors and market participants have been highlighting this recently.

Last week, the JSE saw an average value traded of R15.8 billion a day (according to JSE data) versus R21.5 billion in the same week last year. This is a decline of 27%. Staying at these levels would put the JSE back at levels last seen nearly a decade ago.