Dear valued partner,

As you are aware, interest rate cycles play a pivotal role in the financial landscape, impacting investment decisions, borrowing costs, and overall economic performance. At this juncture, all indicators show that we are now at the peak of an interest-rate cycle, presenting a rare and favourable opportunity for your clients to maximise their returns on investments and deposits.

Here’s why we believe it’s essential for our clients and partners to capitalise on this moment:

1. Why now?

The current peak interest-rate cycle opens up various high-yield investment opportunities that promise attractive returns.

2. What should you be on the lookout for?

With interest rates at a peak, banks and financial institutions are offering compelling rates on fixed-term deposits. Encouraging your clients to lock in their funds for longer periods can secure them stable and secured returns, shielded from potential rate declines in the future.

3. What happens after this peak?

Economic indicators and forecasts suggest a potential decline in interest rates after the peak cycle. By proactively advising your clients to take advantage of the current high rates, you position them to reap the benefits of their investments during the subsequent declining cycle.

Making well-informed decisions during such critical market opportunities reinforces your credibility as a trusted financial advisor. Demonstrating your dedication to securing the best outcomes for your clients will foster long-term loyalty and strengthen your client-advisor relationships… I mean, what client won’t be happy to receive a year-on-year secured growth rate in excess of 10%?

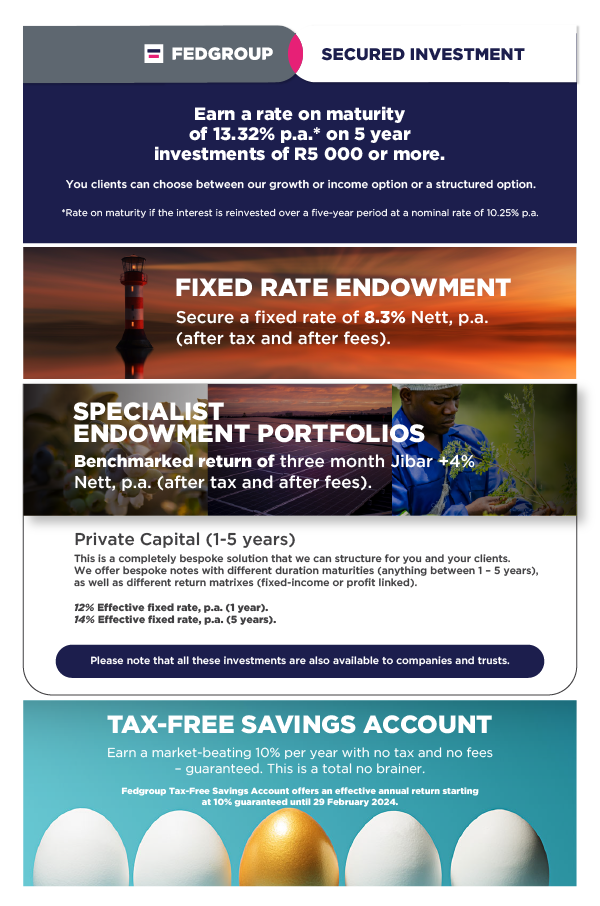

And to ensure your clients take advantage of our current rates over this period, here’s a quick update on Fedgroup’s product offerings: