The Russian invasion will push EU into recession but the inevitable transition to renewables is a long-term positive, says Aegon’s Jacob Vijverberg.

War has landed in Europe. After a long period of peace and stability, Europe is now experiencing a military conflict on the continent. Above all, the situation is heart-breaking and tragic for all people that are dealing with this horrifying situation and humanitarian disaster.

War has landed in Europe. After a long period of peace and stability, Europe is now experiencing a military conflict on the continent. Above all, the situation is heart-breaking and tragic for all people that are dealing with this horrifying situation and humanitarian disaster.

With a coordinated EU and NATO response of sanctions, Russia’s economy and key people have been financially damaged since the start of the conflict. But what of the impact to the EU economy?

Direct economic impact

The war impacts the EU economy via various channels. Trade with the Ukraine and Russia will decline. For the EU, this is however a relatively small impact as the Russian and Ukrainian economies only account for around 1% of total trade. The much more important economic link between the EU and Russia is via imports of energy and other commodities.

The price of oil has risen sharply due to fears that the supply of oil from Russia might decrease. However, the price of gas has risen much faster, as it can’t be as easily diverted or replaced. Europe is therefore dependent on Russian gas imports via various pipelines. The risk that these flows would be cut off has resulted in a sharp price spike.

For now, gas imports keep flowing. A significant part is based on longer term contracts, which Russia might want to honour as they also did during the Cold War. Russia earned around $55bn in 2021 on pipeline natural gas, which is approximately 3% of its GDP. And this figure is likely to rise in 2022, due to much higher prices. There is therefore a strong financial incentive from the Russian side to keep gas flowing.

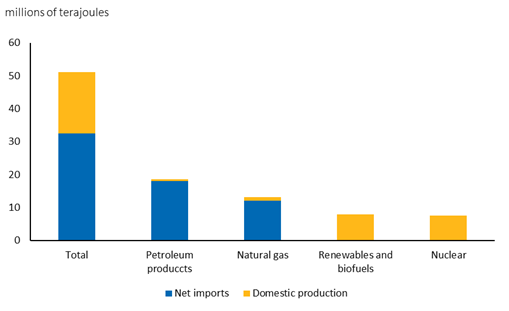

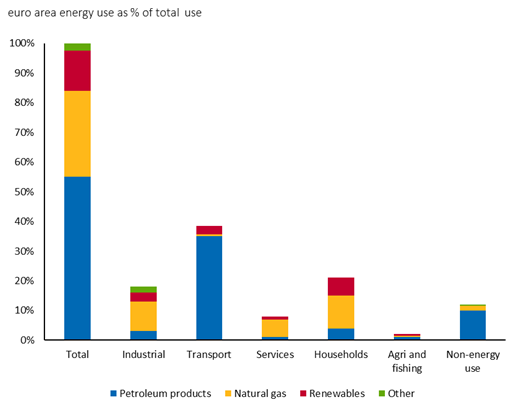

The dependency of Europe on energy imports is clearly seen from the figures below.

Euro area energy dependency

Primary energy usage in the euro area

Europe is still highly dependent on fossil fuels, of which it imports the vast majority. Of the natural gas usages, the majority is used by industry and households for both heating and electricity generation.

Russian gas cut off to cause EU recession

If Russia cuts off its gas, this will result in a recession in Europe as energy intensive production will likely need to be shut. Estimates show that the direct and indirect impact of a hypothetical 10% gas rationing shock on the corporate sector is estimated to reduce euro GDP by about 0.7%. Although such estimates do only consider a subset of all possible channels the economy could be impacted, it does show that the economic activity is sensitive to a gas rationing shock.

Even if gas keeps flowing there will also be a significant hit to the European economy, depending on how long energy prices stay elevated. If oil and gas prices stay at their current levels, this is likely to reduce GDP by approximately 2% during the next two years according to most forecasts. Inflation will in this case also increase up to 8% in the middle of 2022. These estimates are however highly uncertain due to many interlinked effects in a stressed scenario.

The silver lining – EU to accelerate move to renewables

The EU is preparing a set of measures to reduce dependency on energy imports. These include the accelerated deployment of renewables, energy saving measures and attracting LNG supplies. The aim is to cut gas imports by two-thirds.

This seems to be ambitious, but by implementing a combination of measures, especially via more LNG imports, the EU could come a long way towards that target. All these measures will have an economic cost. At this moment, it is unclear whether the EU will increase its debt issuance to fund the accelerated energy transition and its increase in defence spending.

The war has led to a realisation that Europe needs to become independent of Russian energy supplies and that it needs to invest more in European security. It seems that once again a crisis has increased cohesion across European countries.

Initiatives to further develop defence capabilities and a common energy market will result in a further integration of European economies. At this point, it is unclear whether these initiatives will also be funded by common debt issuance, as was done during the pandemic.

Apart from the obvious environmental benefits of investing in renewables, these are also attractive from an economic perspective. Especially compared to current fossil fuel prices, more renewables will produce energy at a significantly lower cost. This implies that the negative effects of high energy prices will slowly revert downwards, resulting in a stronger trade balance and a reversal of the current hit to purchasing power.

Overall, the economy of the EU is 10 times larger than the Russian economy and the EU has the capability to become independent from Russian energy imports. So, although the short-term costs are significant, the longer-term outlook is much brighter.

Jacob Vijverberg is co-manager of the Aegon Global Diversified Income fund. The views expressed above are his own and should not be taken as investment advice.